I never entered the SP500 futures like i wanted to. Its already gone up .5% which is $350 and its not even half way through. You can see in the chart how price consolidated on my resistance line after closing in my area, before pushing up again. I am long a few stocks, so i should still benefit from the strong hourly trend in the market. It looks like the top of a channel for the SP500 daily chart is too close for me to enter a daily trade, but the hourly trend is surging for now.

This blog is geared towards improving my trading knowledge and recording my trades. I am not licensed to give financial advice. Trade at your own risk. It is your fault for losing in this money game.

Thursday, April 28, 2011

Tuesday, April 26, 2011

Exited HPQ short trade for a 2.8% loss. I wanted to see how a short trade would do against the market. It has done a lousy job so i got out of it. Going against the market has proven to be pointless once again. Ill forget about this trade and only trade an equity when its market looks good too from now on.

Most of my current trades are looking good right now. The market is trying to break up through its resistance right now. A new daily uptrend could start soon. There is a nice hourly uptrend right now which is helping my long stock trades.

Most of my current trades are looking good right now. The market is trying to break up through its resistance right now. A new daily uptrend could start soon. There is a nice hourly uptrend right now which is helping my long stock trades.

Monday, April 25, 2011

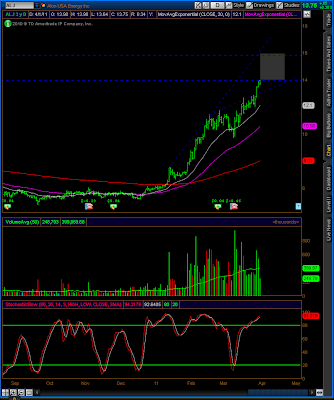

ADM, XOM, /M6E, /LBS entries

Thursday, April 21, 2011

Forgot to exit PFE before the close, ill get out of it by monday. it made a large down bar today. EWA and WAG are looking good. HPQ is not looking good but ill hold onto it. HPQ is going against the market. I wanted to see how well it would do since its downtrend looked good while the market is starting to push up well. The move in X that i watched also is not looking that great and it had a nice downtrend too. Ehhh, i think ill just stick to trading with the market from now on. Trading against the market trend is tricky no matter what the stock's trend looks like.

Thinking about entering right before close into my no resistance areas. Sometimes the area works so well that the first close into it is a big gap. Id rather not miss out on that profit or sit through a temporary pullback. Or i could just enter the trades that give me an entry at the bottom of the area.

Thinking about entering right before close into my no resistance areas. Sometimes the area works so well that the first close into it is a big gap. Id rather not miss out on that profit or sit through a temporary pullback. Or i could just enter the trades that give me an entry at the bottom of the area.

Wednesday, April 20, 2011

WAG long entry

Exited GGB for .6% loss. This was an interesting trade for me. I think i should have exited much earlier and for a decent gain. It had a large down bar. I should have exited after the down bar even though it wasnt right next to my target yet. I need to expect exhaustion after any huge bar. It would have been a less rewarding exit but it would have shown profit. Im already wanting to exit after huge bars that close near my target level but now ill be a little more liberal with it. A huge bar closing in the last 1/3 of the area might be how i'll exit.

Entered WAG for an hourly long trade.

Tuesday, April 19, 2011

Monday, April 18, 2011

HPQ short entry

Exited my /SB short trade for a 10.1% gain. It marched towards its target.

Entered HPQ for a daily short trade.

watching CSCO, INTC, T , ORCL

Thursday, April 14, 2011

PFE, STX, GGB entries

My EWA trade pushed up a little today. I entered PFE for a daily long trade. Entered STX for an hourly long trade. I entered GGB for an hourly short trade. GGB closed far past my preferred entry area and i entered because i had set a market order. If i had been able to watch the trade this morning, i would either have skipped entering or entered on a pullback. Ill just hold onto it though.

I really wanted to short /ES but after looking at it again i thought its hourly downtrend wasnt that great. It would have been a bad short trade. The market went up all day. Now i will look to go long on the hourly chart. Maybe later i will try to go long the market on the daily chart.

I have seen several trades that i missed shoot quickly to their targets like KFT, X and VALE. Oh well. As long as i learn HOW TO fish. I can just eat fried chicken or lasagna for today.

I really wanted to short /ES but after looking at it again i thought its hourly downtrend wasnt that great. It would have been a bad short trade. The market went up all day. Now i will look to go long on the hourly chart. Maybe later i will try to go long the market on the daily chart.

I have seen several trades that i missed shoot quickly to their targets like KFT, X and VALE. Oh well. As long as i learn HOW TO fish. I can just eat fried chicken or lasagna for today.

Wednesday, April 13, 2011

SB futures short entry

Shorted /SB. Trading it on the hourly chart. Hourly trend will probably keep going. Daily s/r is far away and 5 min chart has a big trend that is intact. I made a couple of daytrades on sp500 futures, made 1.25 pts on one and lost .25 pts on another.

Right now many international etf's are looking about the same. Some times different regions trade about the same. This makes it less interesting to me. It becomes harder to find what im looking for. If i could get more comfortable with trading the sp500 futures on a daily chart, then switching over to the hourly chart when the daily is not trending, then i would do that. Just knowing one chart, the SP500 futures, would be nice. Instead of just ignoring it while there is no strong daily trend, i will try to trade hourly trends on it. SP500 futures look like they could be setting up for a nice drop. I will look to short it below 1300.

Tuesday, April 12, 2011

cleaning house today. got rid of almost all my trades. entered and then exited EWK because it was actually sitting just under a weekly 200 EMA. why am i not following my rules? exited RSX for a 3.2% loss. I think i should never have entered it since its daily trend was pretty weak. i want strong trends. exited /GC for a tiny 0.3% loss since it was not in a strong trend either, should never have gotten into it. exited /HO for a tiny 0.2% loss. I should have exited this trade for a few percentage point gain after its big up bar. The big bar closed right under my target but i didn't exit. I should have just gotten out instead of risking a sell off after getting so close. I need to make sure im getting into strong trends that have been around for a little while. I need to follow my rules. Im watching sugar futures /SB for a short trade. It would need to close down a little more and maybe ill short it. The hourly chart is currently in a solid strong downtrend.  I have avoided going long in american stocks which was a good idea. the SP500 has been going nowhere. I have a little string of losses while trying to trade "other markets". What i was considering good daily trends, were actually so-so and risky. I would have done better if i had used the hourly trends. The biggest time frame with a strong trend is what i should be looking to trade in. I think my recent losses are mostly due to me not doing what im supposed to do. I printed out an improved entry/exit checklist which should help.

I have avoided going long in american stocks which was a good idea. the SP500 has been going nowhere. I have a little string of losses while trying to trade "other markets". What i was considering good daily trends, were actually so-so and risky. I would have done better if i had used the hourly trends. The biggest time frame with a strong trend is what i should be looking to trade in. I think my recent losses are mostly due to me not doing what im supposed to do. I printed out an improved entry/exit checklist which should help.

I have avoided going long in american stocks which was a good idea. the SP500 has been going nowhere. I have a little string of losses while trying to trade "other markets". What i was considering good daily trends, were actually so-so and risky. I would have done better if i had used the hourly trends. The biggest time frame with a strong trend is what i should be looking to trade in. I think my recent losses are mostly due to me not doing what im supposed to do. I printed out an improved entry/exit checklist which should help.

I have avoided going long in american stocks which was a good idea. the SP500 has been going nowhere. I have a little string of losses while trying to trade "other markets". What i was considering good daily trends, were actually so-so and risky. I would have done better if i had used the hourly trends. The biggest time frame with a strong trend is what i should be looking to trade in. I think my recent losses are mostly due to me not doing what im supposed to do. I printed out an improved entry/exit checklist which should help.

Monday, April 11, 2011

4.4% loss with DIG. It is an oil and gas etf, so it represents an industry within the american market. i dont like the stock market right now. i think the market pulled this etf down. there is no major resistance on DIG's chart but the market does have some. if im avoiding the american market, then i should also avoid the industries within it. Meanwhile my international etf's are behaving differently.

I think the really good trends i was looking for are in the hourly chart. I would get into the same moves but with more precise entries and exits using the hourly chart. The questionable daily trends that i was seeing were actually great hourly trends that i could have been trading profitable with.

EWK is in a nice trend for an hourly move, i will try to enter it. I missed an hourly move in EWI and i would be getting out of the GUR move right about now if i had entered it and considered it an hourly move.

Sunday, April 10, 2011

Friday, April 8, 2011

Entered RSX today. I had forgotten to check certain etf's that i liked last week. i entered on a pullback but right at the price where i should have first entered. Russia has a daily uptrend within a weekly uptrend. There is several support levels below but no resistance above for awhile. This trade should work......we'll see. .

Wednesday, April 6, 2011

Tuesday, April 5, 2011

/GC, /HO long entries

ALJ had consolidated a little just below its low resistance area but then quickly pushed into the area today. It went too far for me to enter on the daily chart. After the first day its already halfway through. This particular trade is not good for a daily entry anymore but it does show how stocks can still move very well even though the market is slowly climbing through minor resistance levels. remember, its the "teflon" market. its climbing up like a determined sloth. i was thinking i should avoid american stocks until the sp500 could really open up above 1344 but maybe that doesnt matter, unless i was trading the sp500 futures specifically.  I entered /GC and /HO futures. Both look really good. I dont know why i didnt enter /HO yesterday though.

I entered /GC and /HO futures. Both look really good. I dont know why i didnt enter /HO yesterday though.

I entered /GC and /HO futures. Both look really good. I dont know why i didnt enter /HO yesterday though.

I entered /GC and /HO futures. Both look really good. I dont know why i didnt enter /HO yesterday though.

I am watching some stocks: ADSK, AES, AIV, AMZN

I am watching some stocks: ADSK, AES, AIV, AMZN

Monday, April 4, 2011

EWA, DIG long entres

Entered EWA with market order after it closed into its area on Friday. This Australian ETF has a large reward with no weekly resistance in the way for a while, stuck overbought stochastics, strong volume for the first day it closed in the area and EMA's are spreading apart. This is the daily chart, so this move could last a while if it works. DIG is an oil and gas ETF. I found it already sitting inside a nice low resistance area, so i entered it. Volume was decent as it first went into the area.

DIG is an oil and gas ETF. I found it already sitting inside a nice low resistance area, so i entered it. Volume was decent as it first went into the area.

DIG is an oil and gas ETF. I found it already sitting inside a nice low resistance area, so i entered it. Volume was decent as it first went into the area.

DIG is an oil and gas ETF. I found it already sitting inside a nice low resistance area, so i entered it. Volume was decent as it first went into the area.

Sunday, April 3, 2011

Saturday, April 2, 2011

i will only use trendlines from a larger time frame. by doing this, i did increase a couple of the low resistance areas in the assets im curently watching. all time frames affect price, but the next larger time frame is what makes or breaks trends for the next lower time frame. when i was trading on a daily chart, i could see how daily trend lines mattered. but they usually dont matter much. whatever problems they cause are necessary when riding a trend. i have to get used to a little volatility here and there. if im not using a larger time frame's lines only, then i usually take on a bad risk/reward ratio with a small reward.

Friday, April 1, 2011

Im still watching EWA(australia), EWQ(france), EWO(austria), ALJ, /GC(gold), /HE(lean hog), /HO (heating oil)and /QM(light sweet crude oil). I stopped watching ALXN because i found a flaw in it. i dont think ill mess up any trend lines on anything im watching. my mistake with /NQ had to do with a chart setting which i took off.

/NQ hourly long entry and exit, (bad trade)

Nasdaq and SP500 futures moved up into my low resistance area this morning. I had to go to a hospital for a physical therapy visit so i missed the market's first close into my area. Nasdaq happened to pull back enough for me to just enter late. SP500 never really gave me a chance for a good entry anyways. Nasdaq looked better to me yesterday. With my entry at 2352.75, just two points above where i would have entered (the peach dot), i will see if i can get over 20 points out of this move. With one Nasdaq futures contract that would be a gain of about $400. Now ill just wait, which is 90% of trading.  After 2pm the market started selling off. I was suprised because i had confidence in my Nasdaq chart. In about 20 minutes this trade turned completely to crap. Since im using playmoney i didn't exit right away after the first big down bar and just started looking over everything to see what went wrong. I found a mistake. On that particular chart, i had it set on "show extended session"(after hours trading). One big high that i used for a rising resistence line , solid peach,used this high. This high was from a 1 minute boom/bust in after hours trading. When i stopped showing extended trading on the chart, the high was gone. A one minute long rally in after hours is worthless. So when i then drew in the correct rising trendline, in dotted peach, it went directly to where the sell off started. The market started selling at the resistance line that i should have drawn, damn. The correct line cut my low resistance area in half, so i should never have made that trade. THe ES chart also started selling from a resistance line that i did draw correctly. /NQ was looking better than /ES to me but it turns out that neither ever looked good for what i wanted. Technically, my trade lost 18 points but if this was with real money i would have gotten out around -10 points. From now on, i won't use after hours trading on my charts since it can trick me on intraday time frames. I never had to worry about it for a long time since i only traded on the daily chart for months.

After 2pm the market started selling off. I was suprised because i had confidence in my Nasdaq chart. In about 20 minutes this trade turned completely to crap. Since im using playmoney i didn't exit right away after the first big down bar and just started looking over everything to see what went wrong. I found a mistake. On that particular chart, i had it set on "show extended session"(after hours trading). One big high that i used for a rising resistence line , solid peach,used this high. This high was from a 1 minute boom/bust in after hours trading. When i stopped showing extended trading on the chart, the high was gone. A one minute long rally in after hours is worthless. So when i then drew in the correct rising trendline, in dotted peach, it went directly to where the sell off started. The market started selling at the resistance line that i should have drawn, damn. The correct line cut my low resistance area in half, so i should never have made that trade. THe ES chart also started selling from a resistance line that i did draw correctly. /NQ was looking better than /ES to me but it turns out that neither ever looked good for what i wanted. Technically, my trade lost 18 points but if this was with real money i would have gotten out around -10 points. From now on, i won't use after hours trading on my charts since it can trick me on intraday time frames. I never had to worry about it for a long time since i only traded on the daily chart for months.

i trade perfectly, april fools

i trade perfectly, april fools

After 2pm the market started selling off. I was suprised because i had confidence in my Nasdaq chart. In about 20 minutes this trade turned completely to crap. Since im using playmoney i didn't exit right away after the first big down bar and just started looking over everything to see what went wrong. I found a mistake. On that particular chart, i had it set on "show extended session"(after hours trading). One big high that i used for a rising resistence line , solid peach,used this high. This high was from a 1 minute boom/bust in after hours trading. When i stopped showing extended trading on the chart, the high was gone. A one minute long rally in after hours is worthless. So when i then drew in the correct rising trendline, in dotted peach, it went directly to where the sell off started. The market started selling at the resistance line that i should have drawn, damn. The correct line cut my low resistance area in half, so i should never have made that trade. THe ES chart also started selling from a resistance line that i did draw correctly. /NQ was looking better than /ES to me but it turns out that neither ever looked good for what i wanted. Technically, my trade lost 18 points but if this was with real money i would have gotten out around -10 points. From now on, i won't use after hours trading on my charts since it can trick me on intraday time frames. I never had to worry about it for a long time since i only traded on the daily chart for months.

After 2pm the market started selling off. I was suprised because i had confidence in my Nasdaq chart. In about 20 minutes this trade turned completely to crap. Since im using playmoney i didn't exit right away after the first big down bar and just started looking over everything to see what went wrong. I found a mistake. On that particular chart, i had it set on "show extended session"(after hours trading). One big high that i used for a rising resistence line , solid peach,used this high. This high was from a 1 minute boom/bust in after hours trading. When i stopped showing extended trading on the chart, the high was gone. A one minute long rally in after hours is worthless. So when i then drew in the correct rising trendline, in dotted peach, it went directly to where the sell off started. The market started selling at the resistance line that i should have drawn, damn. The correct line cut my low resistance area in half, so i should never have made that trade. THe ES chart also started selling from a resistance line that i did draw correctly. /NQ was looking better than /ES to me but it turns out that neither ever looked good for what i wanted. Technically, my trade lost 18 points but if this was with real money i would have gotten out around -10 points. From now on, i won't use after hours trading on my charts since it can trick me on intraday time frames. I never had to worry about it for a long time since i only traded on the daily chart for months.

Subscribe to:

Posts (Atom)